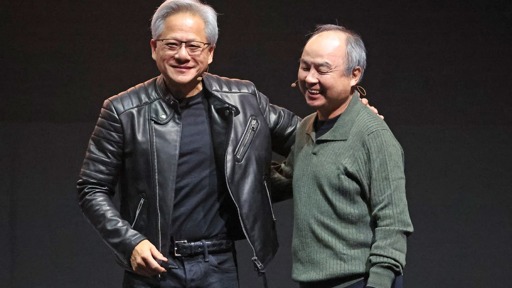

“This should not be seen, in our view, as a cautious or negative stance on Nvidia, but rather in the context of SoftBank needing at least $30.5bn of capital for investments in the Oct-Dec quarter, including $22.5bn for OpenAI and $6.5bn for Ampere,” Rolf Bulk, equity research analyst at New Street Research, told CNBC.

When I read that, I was puzzled; when the bubble bursts, OpenAI will be way more affected than nVidia, as the later is basically the guy selling shovels in the gold rush. And odds are SoftBank’s CEO knows it; so why are they moving its investments this way?

Then I remembered this often quoted excerpt from The 18te Brumaire of Louis Bonaparte applies here: “Hegel remarks somewhere that all great world-historic facts and personages appear, so to speak, twice. He forgot to add: the first time as tragedy, the second time as farce.”

The “first time” here is the dotcom bubble, often compared with the current AI bubble. When the internet was becoming popular, you had that flood of dotcom businesses with overpriced stocks, stocks went brrr then kaboom, bursting around early '00. Like this:

Note however how sharply the prices raised in '99. I think SoftBank is betting on that: buy stocks, sell them juuuuust before the bubble bursts, and you got some nice profit.

Softbank is part of the “Stargate” project to build a $1 trillion AI manufacturing hub in Arizona. At least that’s what I read on another article. I think OpenAI is supposed to be part of it too.

Softbank has a history of knowingingly inflating private market prices with additional small investments at a higher valuation (with syndicated other people’s money) to make their overall investment value appear to be going up. They sell out at IPO or later rounds.

That explains it - they’re most likely doing it with OpenAI.

…I’m low-key wishing the bubble bursts before SoftBank is able to cash out.

“BOOOM!” / The Big Short

Nah but really. They are purposely trying to fuck the economy, so they can buy up shit on the cheap and own even more. They do this every decade and half or so. We’ve recovered from 2008 and the pandemic, so now’s a great time to consolidate their wealth, and wealth is power, and power will only concentrate over many seasons like Goku charging up.

(this is formal official legal and financial advice btw)

Screenshotted. You’ll probably get hearing from my lawyers in a year or so. If I can still afford them.

Don’t worry, I’m right about this.

Oh. Well in that case, thanks!

Cashing out before the AI bubble bursts?

I know it will fuck us over, but oh my god, I can’t wait to not hear about AI in everything, including corn flakes.

Something about to pop…?

supposedly, this is to increase stake in OpenAI. I think Nvidia is far more certain value/sustainability than highly competitive LLM market that OpenAI is falling behind in (Kimi K2 thinking release this week beats it on all benchmarks at 1/4 the memory footprint, and very cheap training costs, that because it is open, can be run privately, with fine tuning based on tasks.).

Hopefully my OpenAI girlfriend will blackmail me into paying them all my money… or China will win.

deleted by creator